We have all heard of a Roth IRA account, but many of our clients have not heard of all of the benefits. You’ll remember in episode #5: The Tax Triangle, we mentioned Roth IRA accounts while talking about the “Tax-Free” bucket. Today, we’ll deep dive into Roth IRA accounts and list the top reasons to invest in one.

Roth IRAs were created as part of the Tax Relief Act of 1997. In case it ever comes up in a trivia question, Roth IRAs were named after Senator William Roth of Delaware. The word “Roth” is synonymous with tax free savings accounts that can be used in retirement. Owning a Roth IRA is about as common as owning a home for our doctors and there are many good reasons why:

Reason #1: Another Way to Save Money for Retirement

Many of our doctors are maxing out their traditional retirement accounts at work. Most are saving the maximum amounts in their pre-tax 401k and 403b accounts, but still want to save more for retirement.

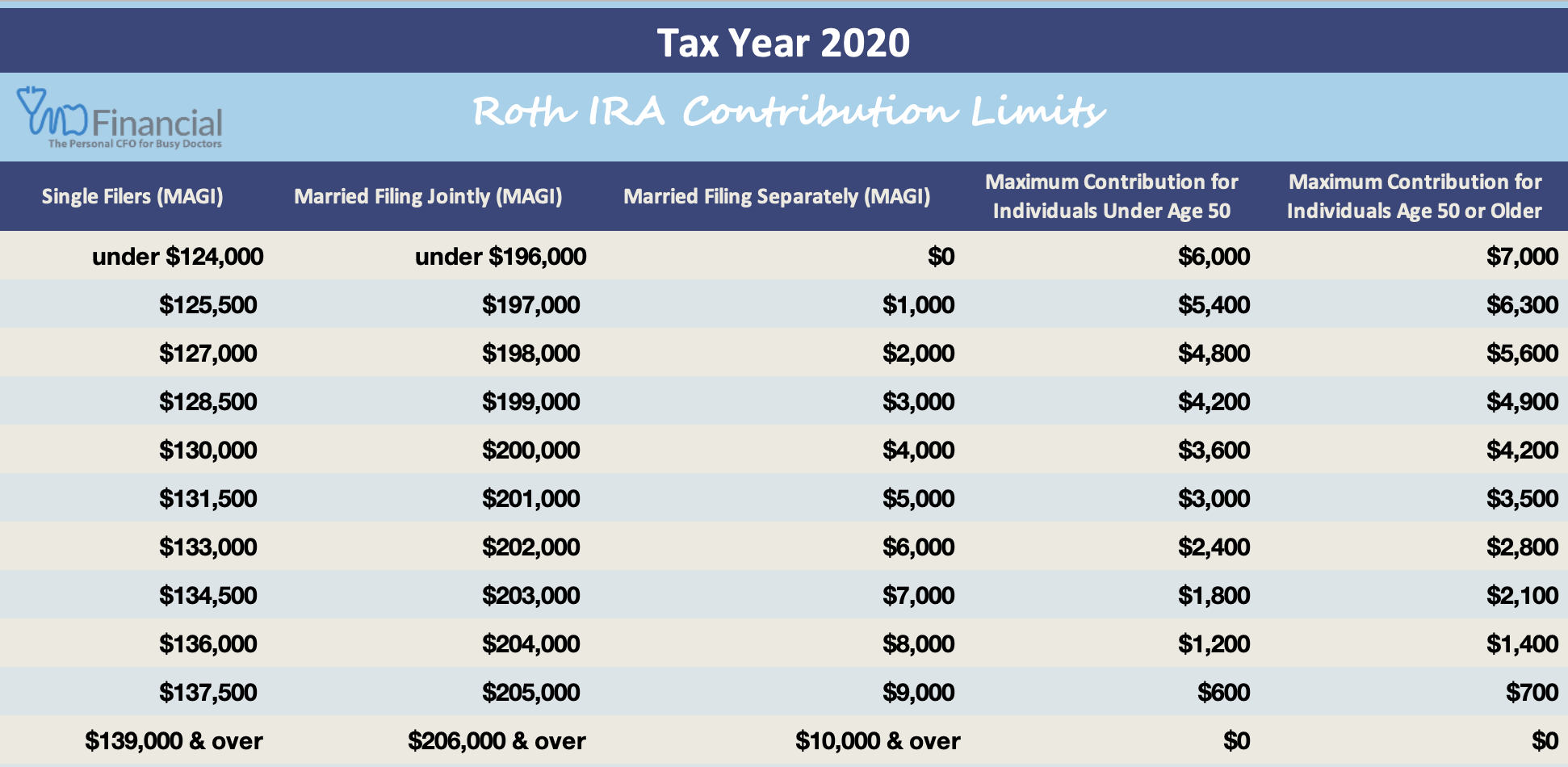

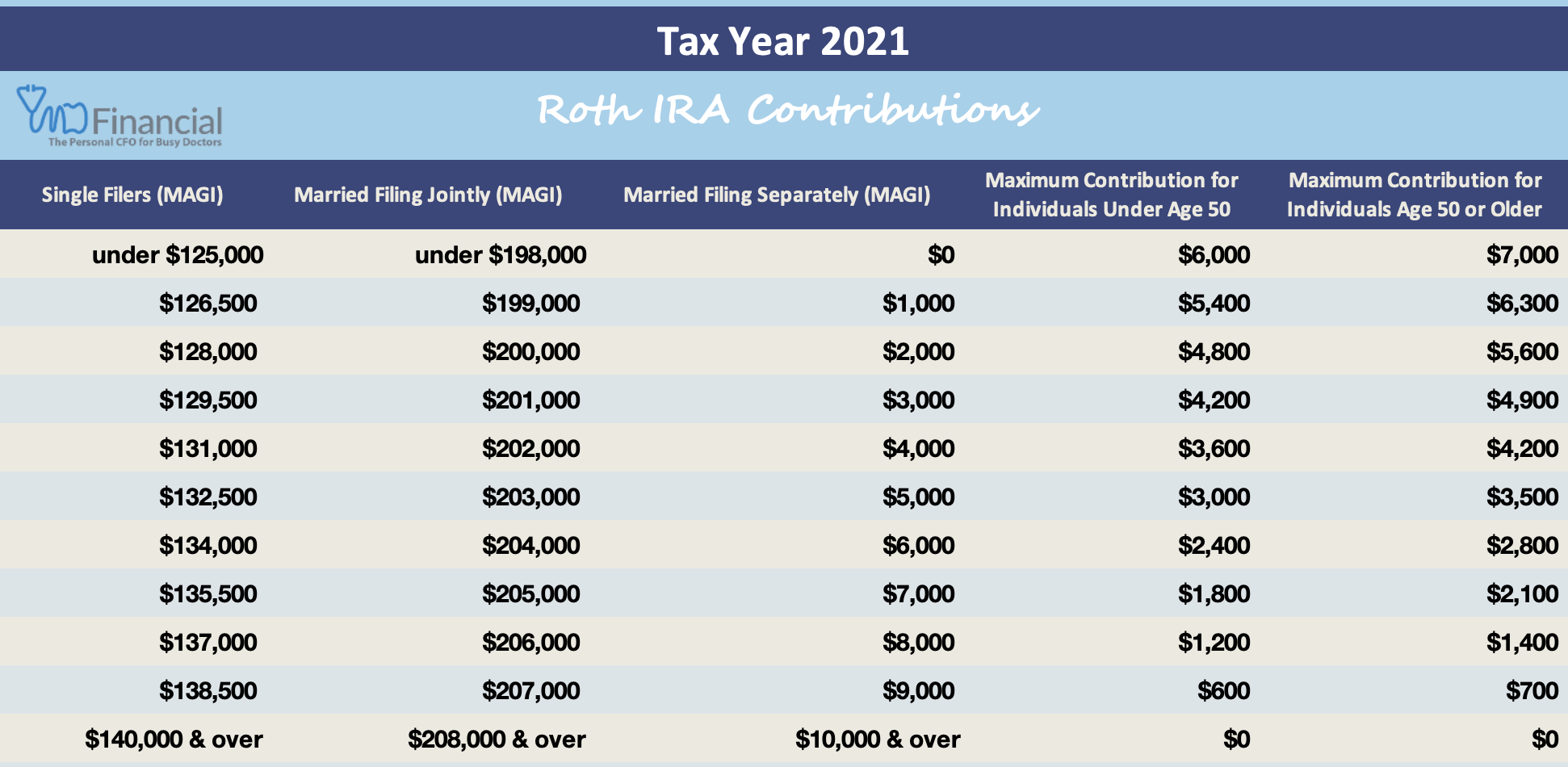

There is a max contribution for Roth IRA accounts. The chart below outlines the various contribution levels.

*Source: Charles Schwab Roth IRA Contributions, found here.

If you and your family don’t qualify for a direct contribution, Roth IRA accounts do have some flexibility in how to invest with other options. Don’t be dismayed! We’ll discuss these in just a moment.

Reason #2: Tax-Free

Money placed in a Roth account is post-tax money. The accounts grow tax-free throughout the time they are invested. Distributions that are withdrawn from the Roth IRA account in retirement do not incur any taxes.

It is important to note that you cannot deduct contributions on your taxes now.

To avoid early withdrawal fees, beside a few exceptions, you cannot withdraw funds before age 59 ½. You cannot withdraw funds tax-free until it’s been at least 5 years since you’ve contributed to the Roth IRA account.

We never recommend putting money into these accounts if you think you may need access to the funds in the next few years.

Only invest funds that you can “forget” about.

Reason #3: Flexibility

Direct contributions can be done up until the Tax Day for the following year.

You have the ability to convert existing pre-tax IRA funds to a Roth IRA account.

While many attending doctors are unable to directly contribute to a Roth IRA account due to income limits, they may be able to contribute using the Backdoor Roth Conversion Strategy.

This involves contributing post-tax money to a traditional IRA account and then converting the funds to a Roth IRA account. As long as there are no market gains before the conversion, this is a tax-free event.

You can contribute to a Roth IRA account as long as you are working. For our doctors who love their jobs so much that they never want to quit, Roth IRA contributions do not need to stop at age 70 ½ like traditional IRA contributions.

No Required Minimum Distributions (RMDs) for Roth IRA accounts.

We are big fans of tax-free income in retirement. We recommend meeting with your advisor or tax accountant to see how a Roth IRA could help you achieve your retirement goals. If you don’t qualify for the direct Roth IRA contribution, you may be able to take advantage of the Backdoor Roth Conversion Strategy. We want to protect your retirement funds to make sure that you have every advantage possible when it comes to retirement. One of those options is having some of the funds available to you tax-free.

Listen on Apple Podcast or Google Podcast

CONTACT US

1-888-256-6855

Remember that you can send us any questions or potential topics at: Info@MDFinancialAdvisors.com

Katherine Vessenes, JD, CFP®, is the founder and CEO of MD Financial Advisors who serve 500 doctors from Hawaii to Cape Cod. An award-winning Financial Advisor, Attorney, Certified Financial Planner®, author and speaker, she is devoted to bringing ethical advice to physicians and dentists. She can be reached at Katherine@mdfinancialadvisors.com.

![Roth IRA Accounts for Doctors [Podcast]](https://images.squarespace-cdn.com/content/v1/561feb4ee4b0de0eb30d6d3c/1617805874084-K001PUGHL2JRD5EQ3WRA/aaron-burden-cEukkv42O40-unsplash.jpg)