Special guest, Josh Lantz, CRPC®, Chief Investment Officer and Financial Advisor, joins Katherine Vessenes, JD, CFP® in today’s podcast about tax-efficient investing. With tax season upon us, you may be wondering what you could do differently to minimize taxes in retirement. Today’s episode is all about how we do this for our clients using 3 tax-efficient strategies. When it comes to investing, it’s not what you make, it’s what you keep. We want to help you plan, protect and prosper.

3 Tax-Efficient Strategies

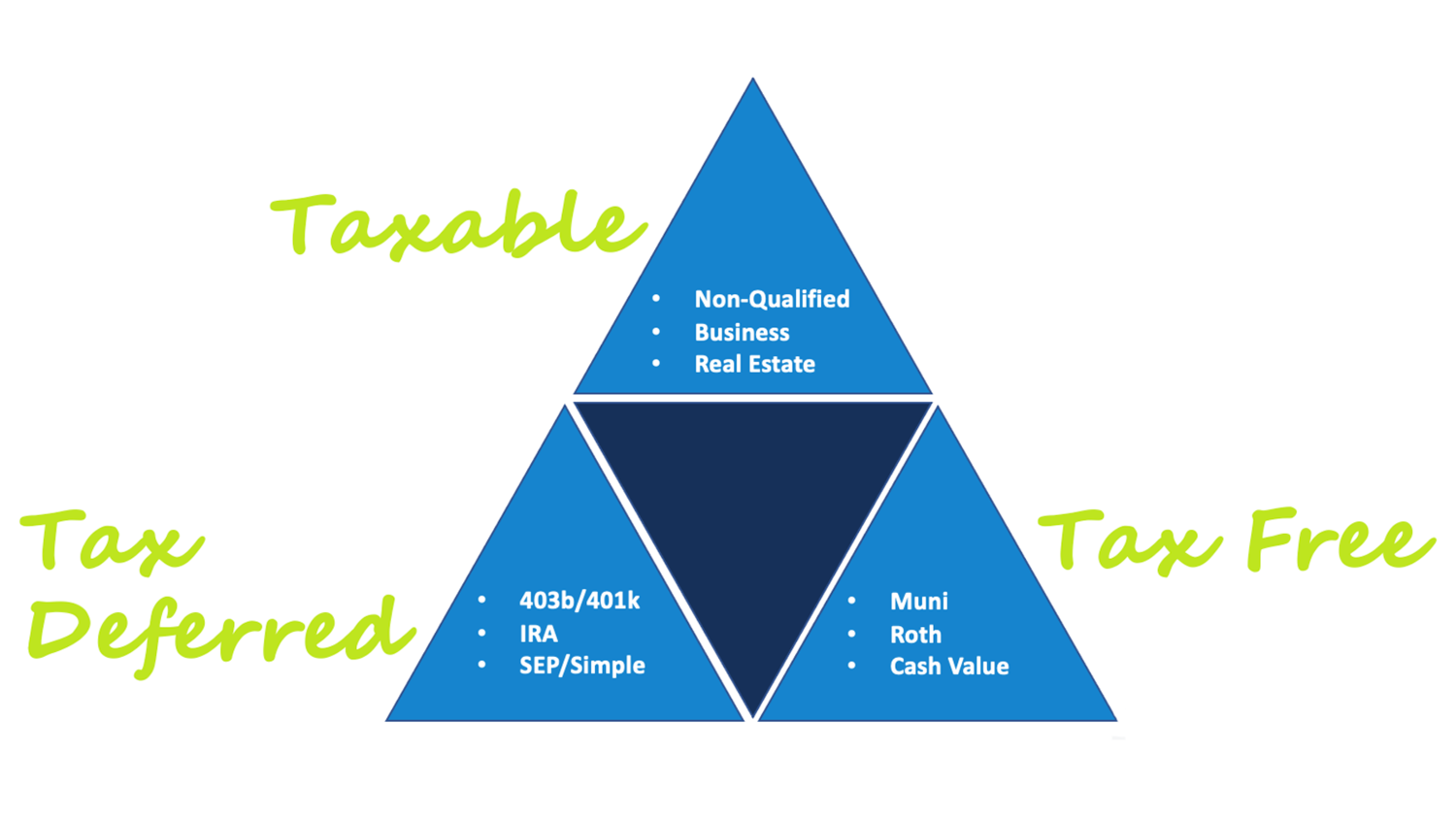

#1 Tax Structure/Tax Control Triangle

If you remember our episode on The Tax Triangle, we recommend clients save money in all three of the tax buckets to provide various options for income in retirement.

If tax rates are higher in retirement, we’d likely recommend the client withdraw needed funds from their tax-free bucket.

If tax rates are lower in retirement, we’d recommend the client withdraw their funds from their tax-deferred bucket.

Being strategic about which bucket to pull from will help our clients best utilize the tax environment in the future. Which bucket to withdraw from, and the amounts you withdraw, can vary year to year.

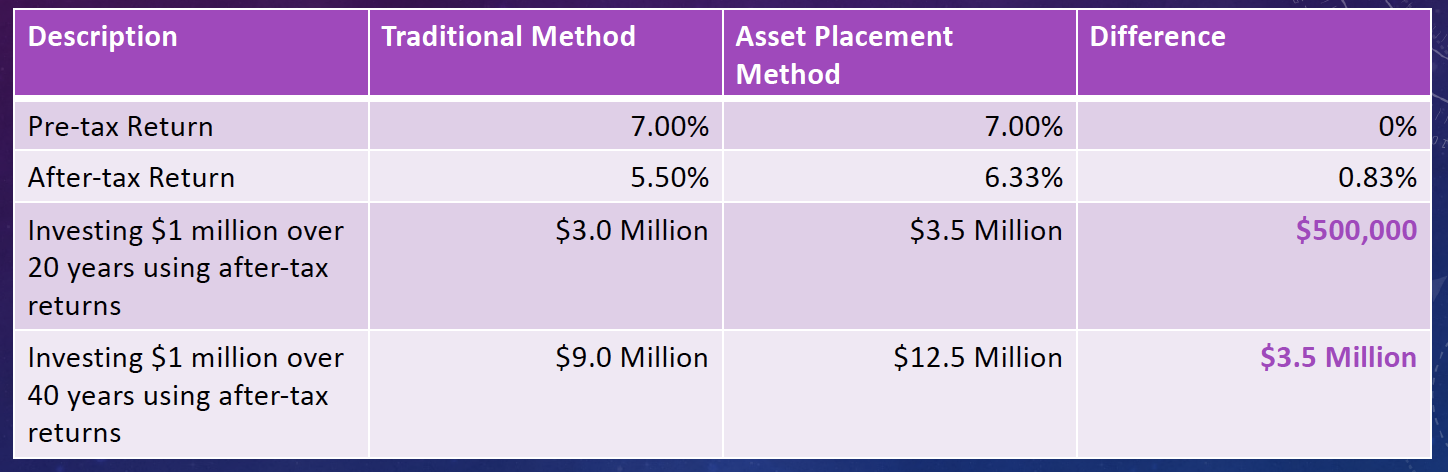

#2 Asset Placement

Our goal in Asset Placement is to create more wealth without increasing investment risk.

What is an asset class?

A group of securities that exhibit similar characteristics. Many are from the same region or similar company size.

Some asset classes have a higher expected return, such as:

Real estate

Emerging markets

Small caps

Some asset classes are not as tax-efficient, such as income producing:

Bonds

Real estate

We want to strategically invest funds in each bucket to maximize returns and create efficiency.

Tax-Now: Most tax-efficient assets

Tax-Later/Tax-Deferred: More conservative assets that are less tax-efficient

Tax-Free: Riskiest assets

*Table is meant to share a hypothetical illustration of the conceptional differences between the Traditional and Asset Placement Method. Everyone’s situation varies. The strategy could benefit you more/less based on numerous factors. Actual results will vary. Investing involves risk. Past performance is no guarantee of future results. Hypotheticals above are not a guarantee of future results.

#3 Tax-Efficient Funds

This strategy only focuses on the Taxable/Tax-Now bucket of the triangle.

The strategy is about using special mutual funds or ETFs designed to live in the Taxable bucket. These investments are designed to be more tax efficient. This means you get to keep more of your returns.

What do these special tax efficient investments do?

Screen out most short-term capital gains (short term capital gains are taxed at a higher rate.)

Screen for qualified dividend income which are taxed at a lower rate.

You work hard for your money, so let’s make your money work hard and efficiently for you. Make sure you are seeking tax diversification in your long-term investments. Utilize asset placement among your investment accounts to make the most of your money now, but more importantly, in the future.

Listen on Apple Podcast or Google Podcast

CONTACT US

1-888-256-6855

Remember that you can send us any questions or potential topics at: Info@MDFinancialAdvisors.com

Katherine Vessenes, JD, CFP®, is the founder and CEO of MD Financial Advisors who serve 500 doctors from Hawaii to Cape Cod. An award-winning Financial Advisor, Attorney, Certified Financial Planner®, author and speaker, she is devoted to bringing ethical advice to physicians and dentists. She can be reached at Katherine@mdfinancialadvisors.com.

Josh Lantz, CRPC®, CIO and Financial Advisor at MD Financial works diligently with all our teams to coordinate the services we provide for our clients. He wants to make sure all our clients have sound, fiscally responsible, financial plans and feel more comfortable about their future. He can be reached at Josh@mdfinancialadvisors.com.

![Tax-Efficient Investing for Doctors [Podcast]](https://images.squarespace-cdn.com/content/v1/561feb4ee4b0de0eb30d6d3c/1619460319375-DZ0FCROUH3HT7KTA0I50/piret-ilver-98MbUldcDJY-unsplash.jpg)