Whether you are on the receiving end of an inheritance or are doing your own estate planning, today’s podcast topic is something every doctor needs to be thinking about. Back in episode #19 (released August 2021), we talked about estate planning and how varied these taxes can be, depending on where you reside. As a refresher, we’ll start off with the basic difference between Estate and Inheritance Taxes, and delve into state-by-state details that are relevant to you.

Estate v. Inheritance Tax

Estate

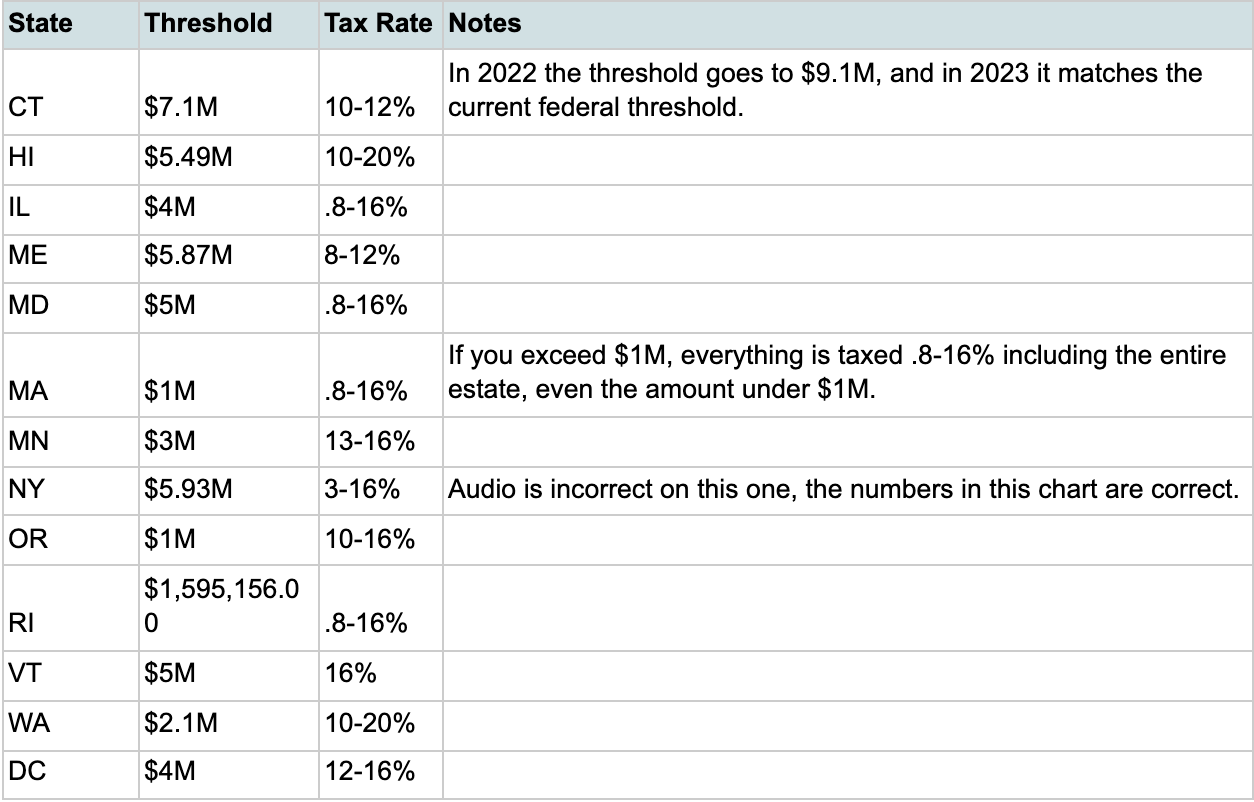

Based on the value of all property owned by the decedent at time of death; taxes are paid for by the estate before distribution. States that have estate taxes:

CT

HI

IL

MA

MD

ME

MN

OR

NY

RI

VT

WA

DC

Inheritance

Based on value an individual receives from the estate, and is paid by the individual. States that have inheritance taxes:

IA

KY

MD

NE

NJ

PA

One, both, or neither tax type could be a factor when someone dies.

Federal Estate Taxes

The US has federal estate taxes on any estate over the threshold of $11.7 million for individuals, $23.4 million for a married couple. This means it’s possible to get taxed at the state and federal level! The threshold provision mentioned above does expire on 12/31/2025. Once that happens, it will be reevaluated and possibly even lowered, which might cause problems. Even small life insurance policies can add to your estate and get you closer to the threshold.

Our current tax rate is at 18-40%, but that hasn’t affected most clients with the current thresholds.

Step-Up In Basis

Something else possibly changing soon is the Step-Up in Basis. A Step-Up in Basis adjusts the value of an asset when it passes from an owner to their heir depending on current values. If this goes away, market to market every year you have to pay capital gains, even if the gains are unrealized! This would also affect estates; at death, beneficiaries would no longer get step-up in basis, and would have to pay taxes on all the long-term gains that had been postponed by the decedent.

Estate Taxes State-by-State

Inheritance Taxes

What is the conclusion? Plan ahead! We want to make sure the minimal amount of taxes are left to your loved ones, so you can minimize the stress of estate planning!

How do we do this? By setting up living trusts, irrevocable trusts, and grantor retained annuity trusts for you. In addition to setting up these accounts, we encourage you to reach out to your local attorney for your state’s estate/inheritance laws. On a final note, watch the news, so you aren’t caught off-guard with these ever-changing tax regulations.

Listen on Apple Podcast, Google Podcast or Spotify

CONTACT US

1-888-256-6855

Remember that you can send us any questions or potential topics at: Info@MDFinancialAdvisors.com

Katherine Vessenes, JD, CFP®, is the founder and CEO of MD Financial Advisors who serve 500 doctors from Hawaii to Cape Cod. An award-winning Financial Advisor, Attorney, Certified Financial Planner®, author and speaker, she is devoted to bringing ethical advice to physicians and dentists. She can be reached at Katherine@mdfinancialadvisors.com.

![Doctor's Estate and Inheritance Tax [Podcast]](https://images.squarespace-cdn.com/content/v1/561feb4ee4b0de0eb30d6d3c/1635525258130-M0RGK5FAOXFGTQBTXLW6/pexels-zen-chung-5529587.jpg)