Biden Administration Tax Law Changes that May Affect Doctors

A few notes before getting started:

The numbers presented can all change, they are based on things said/alluded during the presidential campaign.

We also don’t know if this will be in effect for 2021 or 2022 at the time of this recording (January 11th, 2021.)

Many of our doctors have shown interest/concern as to what new tax laws will come into place with the new presidential administration. As we don’t know the exact numbers at this time, we have compiled some of the main topics brought up during the presidential campaigns, compared the two administrations, and then made a side-by-side presentation. To make it easier to follow along, we have attached the slides presented in our video below.

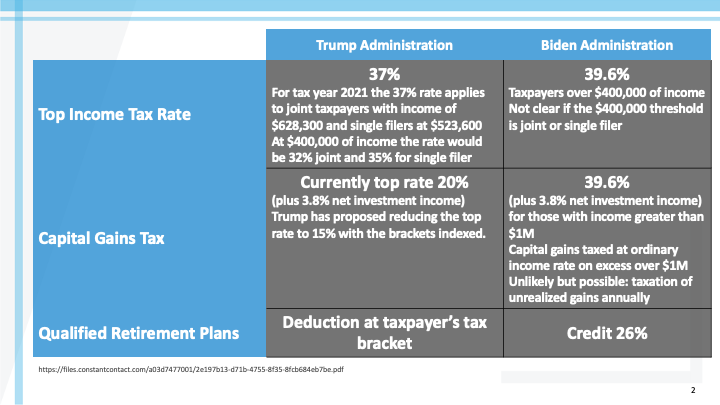

Top Income Tax Rate

The Biden administration wants to revert the Top Income Tax Rate to 39.6%, the rate prior to the Trump administration.

Capital Gains Tax

We see the trend leaning toward increasing Capital Gains Tax for households making more than $1 million/year. This may come into play for our doctor couples or those in specialties making around that threshold.

If any of our clients watching are in this category, let us know, as we may want to realize some of the brokerage accounts you have, and collect on those capital gains before this goes into effect. Please reach out to us at info@mdfinancialadvisors.com.

This tax applies to business owners, brokerage accounts, real estate, etc.. It does not apply to Roth accounts and 401ks.

Qualified Retirement Plans

Currently, if you are putting money into your 401k/403b through work, you are getting the equivalent of 37% deduction as you aren’t taxed on those contributions.

The Biden administration is thinking about capping these deductions to a lower amount, somewhere around 26%.

For higher income earners that are going to be capped out on pre-tax deductions, we recommend discussing Roth vehicles with us.

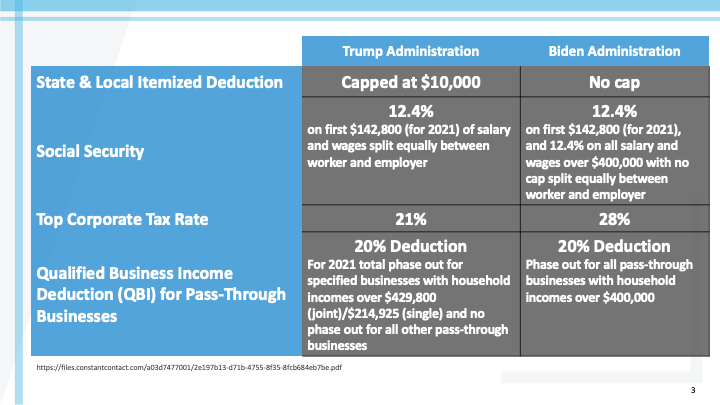

State & Local Itemized Deduction

Before the Trump administration, a lot of states without state income tax didn’t feel their citizens were being treated fairly because they weren’t taxed on income tax at a state level. This equated to these citizens not being able to deduct the state income tax from their federal tax bill.

To combat this exclusion, a cap was put into place in the Trump administration to “even the playing field.”

The proposed idea for the Biden administration will be to remove the cap, which will actually lower taxes for many of our clients who live in states with high state income tax but may open up the issue again with low/no income tax states.

Social Security

As many of our clients know, social security tax is 12.4%, with 6.2% being paid by you (the employee) and another 6.2% being paid by the employer.

In the Trump administration (as of 2021) the taxes are only taken out of the first $142,800.

In comparison, the proposed idea for the Biden administration is a little more complex:

For those making $142,800 or less, you can expect the same social security tax as before (6.2% collected from the employee and 6.2% collected from the employer).

For those making between $142,801 and $399,999, the first $142,800 will be taxed per the point above and the rest will not be subject to social security taxes.

For those making over $400,000, the first $142,800 will be taxed per the first point. The next $257,200 will not be subject to social security taxes, but the income surpassing $400,000 will be taxed at the same rate, (6.2% collected from the employee and 6.2% collected from the employer).

This will not only mean more taxes for employees, but the employer will also need to come up with more funds for their portion of the social security tax.

Top Corporate Tax Rate

This likely doesn’t affect our doctors directly, but it could eat into corporate earnings, as a lot of corporations that are publicly traded are C-Corporations.

If this eats into earnings, it may push down stock prices, meaning less earnings in the market.

Qualified Business Income Deduction (QBI Deduction) for Pass-Through Businesses

The QBI Deduction doesn’t benefit a lot of doctors, because doctors are in a service business where they’re excluded from making this deduction, unless below certain thresholds.

This deduction may apply to side gig doctors, so they may be the ones that are affected if the Biden administration takes it away.

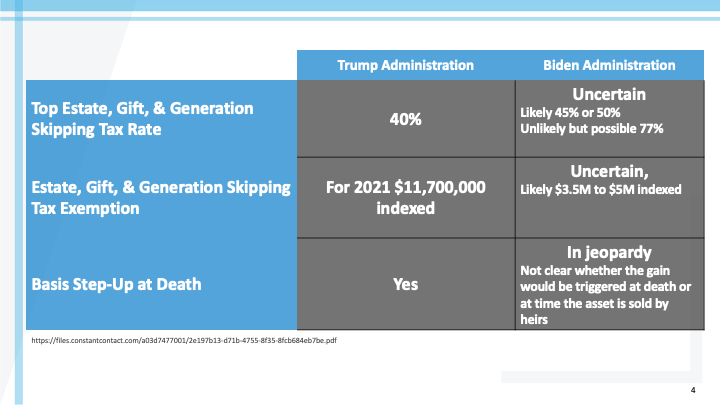

Top Estate, Gift, & Generation Skipping Tax Rate

Currently the top estate tax rate is at 40%, but could change in the Biden administration. This estate tax may be something that doctors need to plan around.

There are many techniques that we use to help make sure these legacies are left to your kids with the least amount of taxes taken out.

Estate, Gift, & Generation Skipping Tax Exemption

Right now we have large thresholds that affect very few doctors, so most are exempt from certain taxes when passing down estates, gifts, etc..

In the Biden administration, the threshold may be brought down to a much lower amount, meaning that this will affect many clients who have previously been planning for their legacy to not be impacted by many taxes.

This exemption lowering can mean estate taxes are going to be more complicated. Feel free to reach out to us today, if you are interested in learning more about how you can prepare to leave your legacy to future generations.

Basis Step-Up at Death

The basic premise is that many brokerage accounts, real estate, and businesses can be passed on to the beneficiaries without a capital gains tax if it’s transferred to them after death.

In the presidential campaign, it was unclear if the basis step-up would still be active, or if it was in jeopardy.

In conclusion, we recommend doctors start putting money aside for extra taxes this year. As doctors are high income earners, this means that tax bills will increase. We don’t know if this will be in effect for 2021 or 2022, at the current time of this recording (January 11th, 2021.) We’d love to work with you in your meetings to help with this planning, to make sure you’ve saved enough and have enough in retirement.

CONTACT US

1-888-256-6855

Katherine Vessenes, JD, CFP®, is the founder and CEO of MD Financial Advisors who serve 500 doctors from Hawaii to Cape Cod. An award-winning Financial Advisor, Attorney, Certified Financial Planner®, author and speaker, she is devoted to bringing ethical advice to physicians and dentists. She can be reached at Katherine@mdfinancialadvisors.com.

Josh Lantz, CRPC®, CIO and Financial Advisor at MD Financial works diligently with all our teams to coordinate the services we provide for our clients. He wants to make sure all our clients have sound, fiscally responsible, financial plans and feel more comfortable about their future. He can be reached at Josh@mdfinancialadvisors.com.