Written by Josh Lantz, CRPC®/ Chief Investment Officer, Financial Advisor

Planning for Long-Term Care

None of us like the idea of getting old, let alone talking about our marginal last decade, but long-term care (LTC) planning is an important part of everyone’s financial plan.

In today’s article we will talk about the long-term care that happens towards the end of life. Keep in mind this can happen to younger individuals too. No matter when it’s needed, LTC can be very expensive.

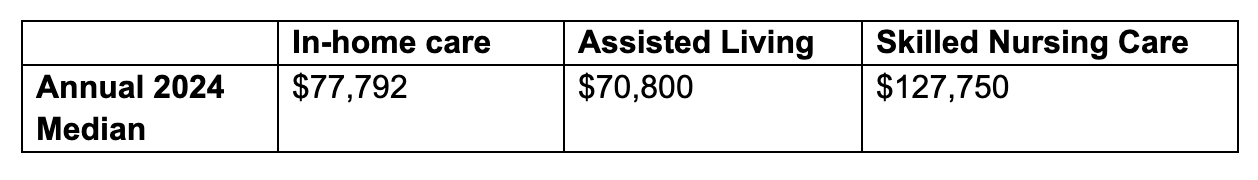

Take a look at the national median annual costs [KB1] in the United States[1]:

Below is a link to survey data that provides median costs for all areas of the country. What you’ll find is that costs vary a lot by location.

Link: https://www.carescout.com/cost-of-care

What is Long-Term Care?

LTC is about meeting the health and personal care needs of individuals who can no longer perform everyday activities independently.

Often this means someone needs support with the following Activities of Daily Living (ADLs):

Walking

Feeding

Dressing

Personal Hygiene

Continence

Toileting

But it can also include support for Instrumental Activities of Daily Living (IADLs)

Cooking

Cleaning

Managing Finances

Managing Medications

Transportation

Shopping

The Financial Challenges

There are many things that make planning for LTC difficult. Here are some of the big challenges:

It’s expensive and is getting more expensive than average inflation rates.

It’s unknown whether friends/family will provide this care.

LTC expenses are unpredictable. Sometimes the cost is $0 and other times the cost is hundreds of thousands of dollars.

56% of those older than age 65 will have some LTC needs.[2]

You might not be able to sell your home to pay for it due to various reasons like:

a. Care is delivered in the home

b. The other spouse wants to remain in the home

c. The individual doesn’t want to sell the home for personal reasons

Often LTC costs can be in addition to someone’s regular retirement living expenses. This can be due to one or more of the following scenarios:

a. Both spouses need LTC support at the same time

b. One spouse doesn’t need LTC support and wants to remain in the home with the same ongoing retirement expenses

c. The care is delivered in the home

LTC durations can last from under a year to, in the more extreme cases, over 10 years. The average duration is 3.1 years. [2]

Emotional Challenges

The emotional challenges around planning for LTC are arguably the greatest. Entire books have been written on this aspect, and this article will hardly do this part justice.

When planning for LTC, it’s often difficult to envision this situation happening to yourself. This can lead to the procrastination of planning for an LTC situation.

The transition to LTC can also be extremely difficult, with changes in identity, changing dynamics with family members, and the difficulty of finding the right facilities and care.

Anyone who has gone through this with an older loved one knows the challenges and heartache involved.

When to Start?

We encourage doctors to start thinking about planning for LTC as early as when they first go into practice, when you run your first retirement projections.

However, with so many debts and expenses to pay in your 30’s, obtaining LTC insurance is more common in someone’s 40’s or 50’s. It’s at that point a doctor might review LTC insurance options.

What are Solutions to Consider?

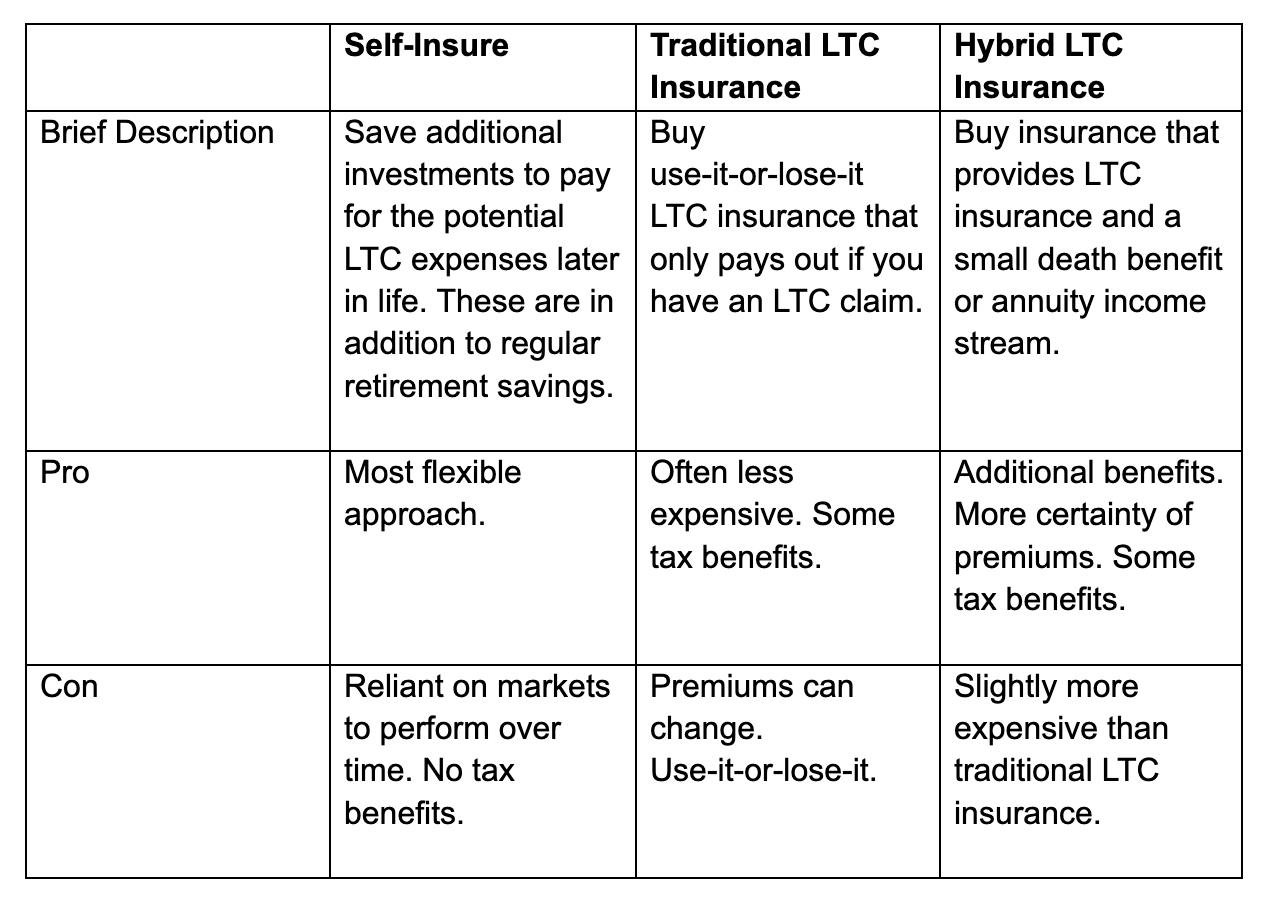

Currently, here are the typical solutions for planning for LTC:

It’s important to mention that all LTC insurance pay out claims are tax-free. That’s a nice tax benefit. In addition, Traditional LTC and Hybrid LTC can provide other tax benefits like deductible premiums up to certain age-based limits in some cases. This is especially helpful for doctors who have side gigs or are practice owners or partners. For these doctors LTC insurance options can look even more attractive.

Medical Underwriting

Obtaining Traditional LTC insurance or Hybrid LTC insurance typically involves medical underwriting. However, keep in mind this medical underwriting is slightly different from the medical underwriting for life insurance and long-term disability. The reason for the difference is they are evaluating slightly different risks.

For example, an LTC insurance underwriter isn’t as concerned about a quick premature death because financially that wouldn’t result in a high insurance claim. They are more concerned with living a long life that results in LTC needs. An LTC underwriting would care more about a greater risk of Alzheimer’s as one example.

Medical underwriting can involve an application, phone interview, medical record review, and sometimes a cognitive test.

What to do next?

If you haven’t already spoken to your financial advisor about LTC planning, this would be a great topic to cover at your next meeting. If you have an interest, please send us an email in advance of your meeting to do more planning in this area.

[1] https://www.carescout.com/cost-of-care

[2] ASPE Research Brief August 2022: Long Term services and supports for older Americans

Josh Lantz, CRPC®/ Chief Investment Officer, Financial Advisor With over a decade of financial planning experience, Josh has worked on more than 500 doctors’ financial plans. “It’s very hard to find a doctor’s situation I haven’t seen before,” says Josh. This is only a snapshot of the expertise Josh brings to MD Financial. He can be reached at Josh@mdfinancialadvisors.com.

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, here. Past performance is not a guarantee of future results.