Written by Ben Kirchner, AAMS© / Financial Advisor

The Doctor’s Guide to Buying Term Life Insurance

You’re going to die someday. As a medical professional, I know that doesn’t shock you. What might shock you is the impact your death will have on those you care about most. As a financial advisor, I’m not here to get philosophical, but I do want to talk about the financial impact your death may have on others. If you have loved ones that rely heavily on your income, it’s time to have the conversation about term life insurance.

What Term Life Insurance Is & Is Not

Life insurance in its most basic form is insurance that pays spouses, heirs, or other beneficiaries in the event of one’s death. A sum of money (generally tax-free) will be paid to pre-determined individual/s. Term life insurance is simply covering the catastrophic risk that comes if you die prematurely or before normal life expectancy. It is not designed to be an inheritance tool for a typical lifespan. It’s meant to cover you in the event you die before then, especially during your working years while others are counting on your income.

What happens if you die without this insurance in place? Your family could be left with hundreds of thousands, if not millions, in lost income, crippling debt obligations, and additional financial obligations such as needing to downsize a home or get additional childcare to make daily life happen.

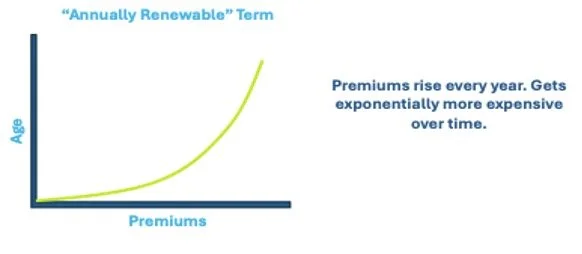

There are two main types of term life coverage. “Annually renewable” term is coverage that starts at a low rate when you’re young and gets more expensive every year. As you age, it gets exponentially more expensive. We do not recommend this kind of coverage for doctors. See the graph below:

Level term coverage has stable or “locked-in” premiums for the term period you purchase. These come in 10, 15, 20, 25, or 30-year options. In essence, these policies become “cheaper” over time due to inflation. For example, a $200/month premium today on a 30-year policy will still be $200/month 29 years later, but the value of $200 will be less at that time. Level term is typically the best solution for doctors and their families.

Term life insurance is only insurance. Like health, homeowners, or car insurance, it will not pay out and you will not get “money back” from the policy unless you die. In other words, the insured never sees the money.

Does Everyone Need Term Life Insurance?

No, not everyone needs term life insurance. For those without dependents or others relying on their income, it’s often not necessary. An exception is if you have significant debts or other financial obligations that become someone else’s responsibility in the event of your untimely demise.

Term vs Permanent Life Insurance

As mentioned above, term life Insurance does not provide the ability to get “money back” from the premiums you’ve paid. So why buy it to begin with? Well, the reason is it’s typically 5 to 15x cheaper than permanent insurance. This allows you to get the coverage you need at a much more affordable rate. This protects your loved ones against catastrophic loss if you die early and frees up dollars to build wealth in other areas.

Permanent life insurance comes in a variety of options (whole life, universal life, index universal life to name a few). When you pay a premium, the money you put in gets split and a portion goes to pay for insurance while the other part of your premium goes into a savings vehicle. There’s a lot of complexities to these products and they can be used for a variety of reasons. They are often a tool for retirement or legacy planning whereas term insurance is used as a primary tool for covering a death benefit need due to its inexpensive cost.

How to Determine Coverage Amount & Term Length

This is highly dependent on several variables. The typical doctor is often looking to cover the following for their beneficiaries:

Payment of any outstanding debts (including mortgage/s)

Cost of 4-year college for kids

Loss of income (adjusted for inflation)

Burial expenses

This frequently ends up being around 10-15x a doctor’s salary. The term length is often chosen to cover the years the dependents are in the home or even until retirement. This typically means that a doctor at the start of their career is looking for a 25-year or a 30-year policy whereas a doctor mid/late career is exploring a 10-year or 15-year policy.

What About Employer-Provided Coverage?

Coverage through an employer is broken into two main categories: basic and supplemental. Basic coverage is usually provided with a modest amount of coverage (such as one or two times salary) and is provided and paid for by your employer. There’s really no reason not to accept or keep this coverage.

Supplemental coverage is typically term coverage that you can buy on top of the basic coverage provided. It’s very affordable early in your career and gets more expensive over time. The premiums tend to be age-banded and go up every four to five years. A level term is typically more expensive on the front-end but more inexpensive over the life of the policy when compared to supplement coverage.

One of the other issues with supplemental coverage is that it’s tied to your employer. In the event you get sick, become unemployed, and die, the coverage may not remain in place. In a few cases, group coverage can continue post-employment, but this is not common.

What If You Change Your Career?

Not a problem! Assuming you have an individually held policy (like level term insurance), it would be independent of your career and employer. That means that the policy is in place until you choose to cancel it or the term ends.

What Impacts the Cost of Coverage?

The cost of coverage is highly dependent on the following factors:

Coverage amount

Term length

Current health & tobacco use

Health history

Sex/Gender

Here are a couple examples of premium costs for a male and female doctors early in their career with a “preferred non-tobacco” health rating. These costs are a simple estimate and are subject to change due to underwriting and the factors previously listed.

Female

$1 million dollars of coverage

31 years old

30-year term

Costs $50.63 per month

Male

$1 million dollars of coverage

31 years old

30-year term

Costs $65.34 per month

Contrast that to doctors later in their career:

Female

$1 million dollars of coverage

51 years old

15-year Term

Costs $98.60 per month

Male

$1 million dollars of coverage

51 years old

15-year Term

Costs $126.46 per month

Where and How Do You Buy It?

I recommend checking with an independent broker, like MD Financial Advisors, who can quote with multiple carriers. This allows them to find you the best deal on coverage and customize a plan that fits your needs. Most carriers involve financial and medical underwriting with a paramedical exam. The paramedical exam entails getting vital signs, height, weight, as well as blood and urine samples. In select cases, underwriters might look at health history in more detail and contact your health providers (with your permission). The underwriting process typically takes 30-60 days to complete.

More recently, coverage options that waive medical underwriting are now available as part of the life Insurance marketplace. An independent broker will have more information on trusted resources to look at in this regard.

In summary, be sure to initiate the conversation around term life insurance if you have loved ones depending on you. It’s a vital part to rounding out your financial plan and making sure that your family is taken care of. Reach out to us today to get a customized plan that fits your family’s needs.

Ben Kirchner, AAMS© / Financial Advisor

After starting his career at two Fortune 100 companies, Ben joined MD Financial in May of 2018. Ben advises over a hundred doctor households, helping them achieve their financial goals. He is passionate about serving. Ben enjoys making sure all of our doctors thrive financially and have a great experience every step of the way. He can be reached at Ben@mdfinancialadvisors.com.

This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, here. Past performance is not a guarantee of future results.