Written by Josh Lantz, CRPC®/ Chief Investment Officer, Financial Advisor

At some point in your career, you’re going to hear from the “Investor Genius Doctor” (IGD). The IGD is the doctor who likes to talk about their great investments and share of their successes. Note, their losses are often not shared as freely. ;)

The IGD can only achieve this outperformance by doing things we commonly recommend against. They can only achieve these higher returns by either concentrating their investments or market timing.

As you know, we highly are against both strategies for reasons I’ll outline below.

Concentrating is the opposite of diversification. Concentrating is when you buy only a handful or companies and/or investments. The idea behind concentrating is you’re going to place a riskier bet for the potential of outsized returns. In another article, we’ll walk through why this is unwise.

Market timing is the other way the IGD could achieve outsized returns. Market timing is commonly referred to as “active management” in investor circles. This could be security selection. Meaning where you try to pick the next Tesla or Google. Market timing could also mean trying to get in and out of the market to avoid the crashes and ride the gains.

As you know we practice an evidence-based investing strategy at MD Financial. The overwhelming academic evidence indicates that market timing doesn’t work. I think you’ve heard us say that many times, but it’s important we share why. It’s even more important to know these things for when you finally meet the IGD.

Market Timing Typically Underperforms

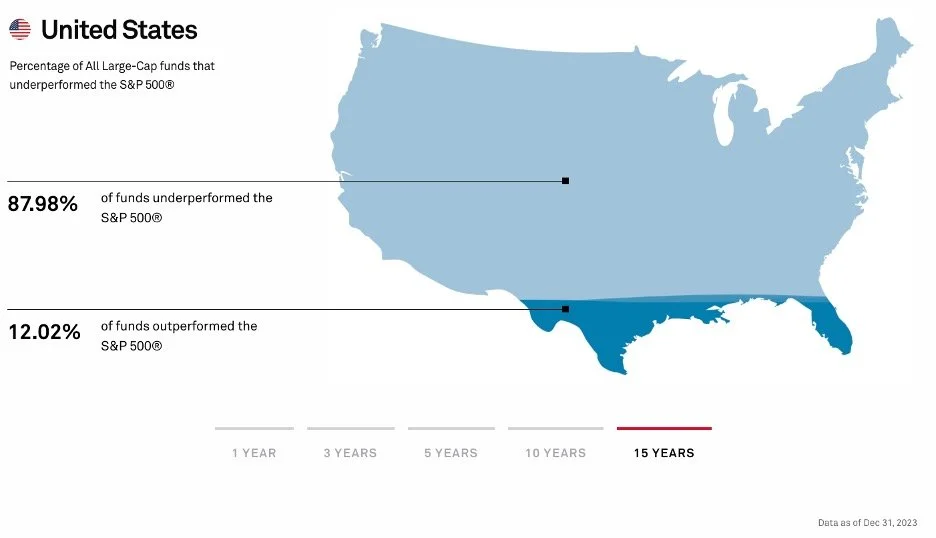

Every year Standard & Poor’s (S&P) releases their annual S&P Indices Versus Active or SPIVA study. You can find it here, if you’re interested. Every year it pretty much says the same thing. The example below demonstrates the underperformance of actively managed large-cap funds in the US. In a 15-year period, 87.98% of the funds underperformed. That means only 12.02% were successful at their job during that period.

You might be saying to yourself. “While it looks hard to do, there are 12% of funds that seem to outperform, maybe I can be part of that 12%”.

A few things to consider first:

Know who you are competing against

Luck versus skill

And taxes

Know who you are competing against

You are very smart! There’s no way you became a doctor without being very intelligent. There are also some very smart people on Wall Street running these funds. Many of them have PhDs in finance, armies of researchers, and technology resources that few can afford. They eat, breathe, and sleep investing as their full-time job.

The point is, if you’re going to time markets, know who you’re up against. Ask yourself, do you really have an edge against Wall Street?

Luck versus skill

Yes, there were 12% who outperformed in US large-caps from above in a 15-year period. However, did they outperform due to luck or skill?

With so many different funds in a normal distribution, over the span of 15 years, we would expect some funds to outperform simply based on luck.

This has already been studied by academics. Nobel laureate Eugene Fama and Kenneth French concluded in their 2009 paper, “Luck Versus Skill in the Cross Section of Mutual Fund Returns”, that after accounting for luck, the percentage of portfolio managers who outperform was close to zero over longer periods.

Impact of Taxes

Lastly, even if the IGD was successful in market timing, when so few are, they would then have to consider taxes assuming they are investing in a taxable account.

S&P has also produced a study on this topic. They reviewed professional mutual fund managers before and after taxes. Here are some of the results. The full report can be read here.

The first chart shows the median mutual fund for US large-caps. The orange bars demonstrate the median manager underperforming an index fund. However, the purple bars factor in taxes. Notice how the purple bars show even greater underperformance after taxes.

It makes sense that the more active you are with your investments, the more taxes eat into your returns. The government taxes you on gains within your investments. If you buy and sell a lot and realize gains, you will create more taxation. You can think of taxation as a fee eating away at your returns.

In the chart below you can see the percentage of funds that underperform. They’re showing you both before and after taxes. Notice, the longer the period, the more the underperformance. Also, notice that after accounting for taxes, the percentage of underperformance always goes up. In US large-cap funds in a 20-year period they underperform 94% of the time. However, after taxes that number becomes 98%!

This is not shared to discourage you. Quite the opposite! There are better ways to invest than the “Investor Genius Doctor” (IGD) might suggest.

We always suggest:

Broadly diversify

Keep internal costs low

Focus on tax-efficient investing

Avoid market timing

Invest based on the academic evidence

Hopefully some of these considerations above give you more confidence next time you’re chatting about investments.

Josh Lantz, CRPC®/ Chief Investment Officer, Financial Advisor With over a decade of financial planning experience, Josh has worked on more than 500doctors’ financial plans. “It’s very hard to find a doctor’s situation I haven’t seen before,” says Josh. This is only a snapshot of the expertise Josh brings to MD Financial. He can be reached at Josh@mdfinancialadvisors.com.

The views expressed are those of the author as of the date noted, are subject to change based on market and other various conditions. Material discussed is meant to provide general information and it is not to be construed as specific investment, tax, or legal advice. Keep in mind that current and historical facts may not be indicative of future results. The information contained in our presentations has been compiled from third-party sources and is believed to be reliable; however, accuracy is not guaranteed.