On our 6th episode of “Money Minutes for Doctors” Dr. Kristina McAteer once again joins Katherine Vessenes, JD, CFP®, Founder and President of MD Financial Advisors to discuss the basics of an IRA. This podcast covers how to choose the right one and how to utilize tax efficient investing.

The basic IRA has been available since 1975, as a way for Americans to save money and get a tax advantage. The great thing about IRAs is that you don’t pay tax as you contribute, nor do you pay as the investment grows.

For anyone interested in investing in an IRA, there are some stipulations:

You, or your spouse, must be working to be able to contribute to an IRA.

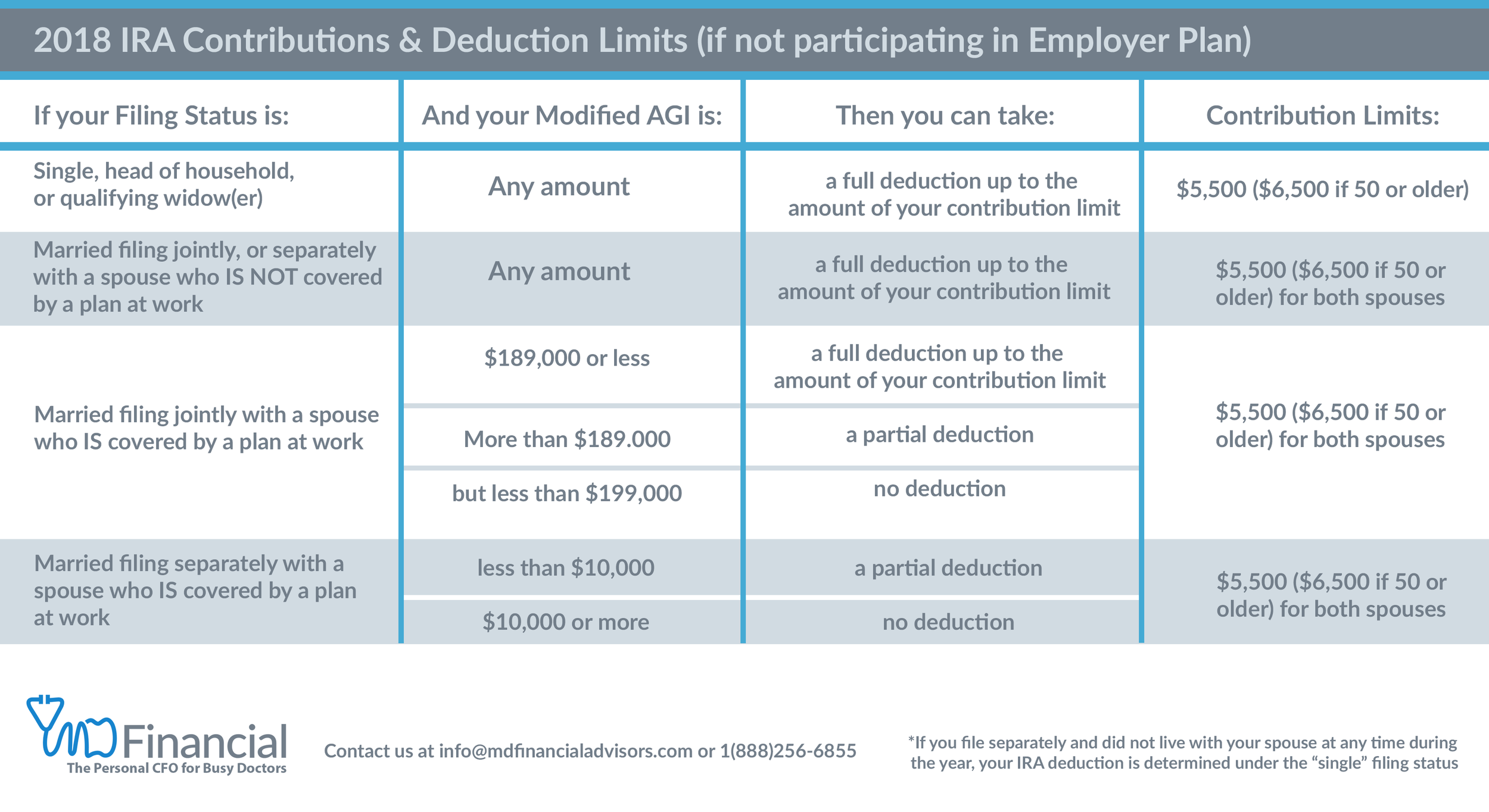

Your contribution is limited to either the amount of your earned income, or the annual limits, whichever is lower. If you are reading this in 2018, the current limit is $5,500 for anyone under the age of 50. If over the age of 50, it increases by $1,000, this is known as a “catch up” contribution, for a total contribution of $6,500.

You can’t contribute after age 70 1/2, even if you are still working.

If you or your spouse has a retirement plan through work, IRA contributions can be deducted from taxable income if your total combined income is under $189,000 (for 2018).

IRA accounts are held at custodians such as banks or investment/brokerage companies. Through these custodians, you are able to choose any investment that they offer including money market accounts, stocks, bonds, mutual funds, etc.

Transactions within the IRA are not subject to any tax until it is withdrawn. Once money is withdrawn, you will owe Federal and State Tax (if you live in a state that practices State Tax).

You can have more than one IRA account, but we recommend combining all IRAs into one account and committing to one investment plan for all investments.

Once you reach 70 1/2, you are required to start withdrawing from your IRA and pay tax on the funds. If you take out before you are of age, you are subject to penalty fees sometimes up to 50% of the funds!

Rolling over funds from an old 401k or a 403b can be done, and is not considered a taxable event.

Takeaway: IRAs are anything but simple. If you are interested or have questions regarding an IRA, feel free to reach out to us and schedule your appointment today. It is best to seek advice from an experienced advisor, to make sure your complex financial needs are met, to set you up for success during retirement. You can also check out the posting here, featured on Brown Emergency Medicine, or on iTunes.

![IRA Basics for Doctors [Podcast]](https://images.squarespace-cdn.com/content/v1/561feb4ee4b0de0eb30d6d3c/1543515297730-QT4DZAFC3W7QVDRDN74E/invest.png)